The United States is grappling with a debt trap of monumental proportions, with total household debt soaring to $18.59 trillion by the end of 2025.

This staggering figure includes $13.07 trillion in mortgage debt and $1.23 trillion in credit card balances, creating a perfect storm for financial stability.

Auto loans show severe strain, with average monthly payments at $750 and subprime delinquencies hitting 6.65%, the highest since the Great Recession.

Federal student loans have 5.5 million borrowers in default, with $140 billion outstanding, while the national debt climbs to $38 trillion, eroding Federal Reserve independence.

In this bifurcated economy, high-income groups remain resilient, but the middle and lower classes are squeezed, facing tough choices daily.

The Anatomy of Modern Debt

Understanding the current debt landscape is crucial for finding a way out.

The table below highlights key statistics that paint a vivid picture of the crisis.

These numbers reveal a deep-seated financial vulnerability that requires immediate attention.

Mortgage rates have frozen the housing market, with homeowners clinging to pandemic-era rates of 3-4%.

Consumer spending, a key GDP driver, is slowing, with luxury markets stable but mid-tier retail declining sharply.

Who Bears the Brunt?

Vulnerable groups are hit hardest by this debt crisis.

- Consumers: Lower and middle-income households face the worst, with 42% skipping basics like rent and food to make payments.

- Sectors: Autos struggle with Ford and GM sales dropping, and regional banks are exposed to auto and commercial real estate loans.

- Winners: Big banks like JPMorgan Chase and Bank of America remain diversified, while discount retailers like Walmart gain traction.

- Borrower Demographics: 51% of Pell Grant recipients are in defaults, facing wage garnishment and Social Security seizures.

- Broader Effects: Buy now, pay later defaults are rising, and a consumer recession looms if unemployment increases.

These impacts show a clear economic divide that demands targeted solutions.

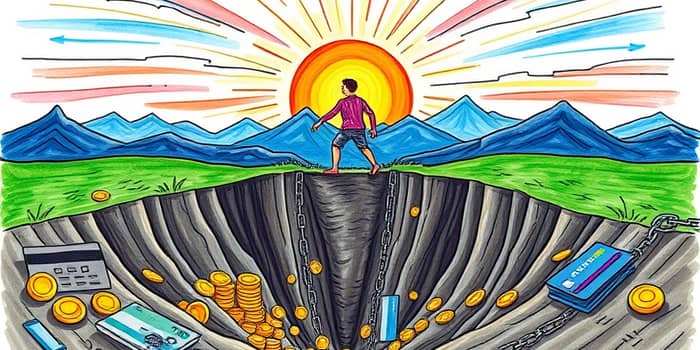

The Vicious Cycle of Debt Traps

Debt traps occur when interest costs exceed revenue or growth, narrowing escape routes.

Advanced economies, including the U.S., are at risk in 2026, with G7 nations projected to have debt exceeding GDP by the decade's end.

- Feedback Loop: High debt raises borrowing costs, suppresses growth, and heightens vulnerability to market swings.

- U.S. Specifics: The lock-in effect freezes the housing market, and student loans amplify risks through a default cliff.

- Sovereign Risks: Potential 2026 crisis signals mirror 1970s stagflation more than the 2008 asset collapse.

This cycle creates a perilous financial environment that individuals must navigate carefully.

Lessons from the Frontlines: Jamaica's Success Story

Jamaica offers a beacon of hope, reducing its debt-to-GDP ratio from 144% in 2012 to 72% in 2023.

Forecasts predict it will drop below 60% by 2026 and 50% by 2030, despite low growth and natural disasters.

- Smarter Spending: Prioritized spending efficiency over volume, implementing fiscal reforms.

- Addressing Productivity: Focused on tackling productivity stagnation to sustain debt reduction.

This case study proves that strategic fiscal management can lead to meaningful debt escape.

Your Roadmap to Financial Freedom

Escaping the debt trap requires actionable strategies tailored to individual circumstances.

- Smarter Budgeting and Spending Cuts: Track expenses and eliminate non-essential costs to free up cash.

- Debt Restructuring and Refinancing: Explore options to lower interest rates or consolidate debts into manageable payments.

- Income Boosts and Side Hustles: Increase earnings through additional work, freelancing, or skill development.

- Building Emergency Funds: Save consistently to avoid new debt during unexpected crises.

- Policy Advocacy and Affordable Plans: Support initiatives for better loan terms and relief programs, especially for student debt.

Implementing these steps can gradually restore financial health and reduce dependency on credit.

AI debt management tools and restructuring firms offer emerging opportunities for those overwhelmed.

Shifting to a 'cash is king' mentality and investing in low debt-to-equity companies can provide stability.

Personal Stories: The Human Cost of Debt

Real-life experiences highlight the urgency of these strategies.

- One survey respondent shared, 'I have to choose between rent, loans, and food every month.'

- Another noted, 'Student loan payments spike under income-driven plans, penalizing any raise I get.'

- Many face wage garnishment or tax seizures, adding to their financial stress.

These stories underscore the critical need for empathy and practical support in debt management.

Future Outlook: Navigating 2026 and Beyond

The financial landscape in 2026 is poised for volatility, with key metrics to monitor.

- Delinquency Rates: Watch for increases in auto, credit card, and student loan delinquencies as early warning signs.

- Earnings Reports: Q1 2026 earnings for lenders and retailers will indicate consumer health and spending trends.

- Policy Changes: OBBBA tax incentives or trade cost hikes could impact debt dynamics unexpectedly.

- Global Trends: BRI debt trap diplomacy risks and sovereign crises may influence U.S. economic stability.

Staying informed allows individuals to adapt proactively to changing conditions.

Conclusion: Bend Without Breaking

Escaping the debt trap is not about avoiding challenges but building resilience.

By adopting proven strategies, from smarter budgeting to income boosts, you can chart a path to freedom.

Embrace tools like hybrid vehicles for cost savings and financial apps for better management.

Remember, every small step counts in reclaiming your financial destiny and achieving lasting peace of mind.

Let this article inspire you to take action today, turning debt from a burden into a bridge toward a brighter future.

References

- https://stocks.observer-reporter.com/observerreporter/article/marketminute-2025-12-30-the-2026-debt-trap-why-surging-mortgage-and-auto-costs-threaten-the-american-consumer

- https://ticas.org/affordability-2/2025-student-debt-survey-blog/

- https://www.csis.org/analysis/breaking-debt-trap-why-spending-smarter-beats-spending-more

- https://www.trustnet.com/news/13465125/from-a-debt-crisis-to-an-ai-pull-back-three-key-risks-for-2026

- https://discoveryalert.com.au/debt-trap-risks-advanced-economies-2026/

- https://fortune.com/2026/01/13/fed-independence-jerome-powell-38-trillion-national-debt-inflation-tyler-cowen/

- https://www.wilsoncenter.org/blog-post/debt-distress-road-belt-and-road